We believe electric cars are great. They reduce emissions by about 75-80% compared to gasoline cars. And they cost less to run because it’s cheaper to run on electricity than petroleum and they require less maintenance. But for the time being, without governmental incentives, the cost of the battery generally makes electric vehicles (EVs) cost a bit more upfront. So federal tax credits and state rebates are important for the next few years until battery costs come down a bit more. If you’re in the market for a new car and considering an EV (as you should!), here’s news you can use.

We believe electric cars are great. They reduce emissions by about 75-80% compared to gasoline cars. And they cost less to run because it’s cheaper to run on electricity than petroleum and they require less maintenance. But for the time being, without governmental incentives, the cost of the battery generally makes electric vehicles (EVs) cost a bit more upfront. So federal tax credits and state rebates are important for the next few years until battery costs come down a bit more. If you’re in the market for a new car and considering an EV (as you should!), here’s news you can use.

Federal Tax Credit:

The federal Internal Revenue Service (IRS) tax credit is for $2,500 to $7,500 per new EV purchased for use in the U.S. The size of the tax credit depends on the size of the vehicle and its battery capacity. To find out specific tax credit amounts for individual vehicles, visit FuelEconomy.gov’s Tax Credits for Electric Vehicles and Tax Credits for Plug-in Hybrids pages. (Please note that how much of the tax credit you can take advantage of also depends on your personal tax liability: learn more here.) This tax credit will be available until 200,000 qualified EVs have been sold in the United States by each manufacturer, at which point the credit begins to phase out for that manufacturer.

Tesla is the first to reach the 200,000 milestone. If you order a new Tesla soon and it's delivered to you by December 31, 2018, you'll get the $7,500 federal tax credit. Tesla has said that to be assured of delivery by that date, you must have ordered your vehicle by October 15. If your car shows up on or after January 1, 2019, the tax credit falls to $3,750 for six months, then to $1,875 for six months before it expires altogether.

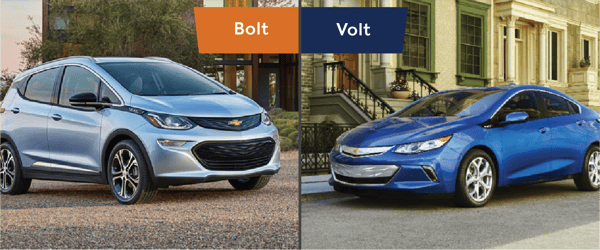

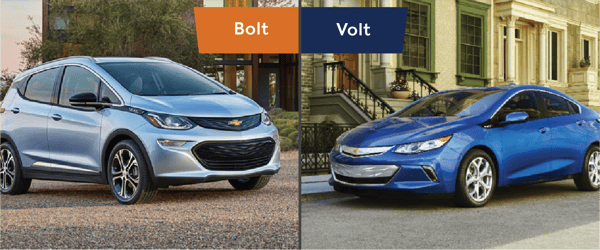

General Motors should be selling its 200,000th EV in the form of a Chevrolet Bolt or a Chevrolet Volt by the end of December or early January.

The date matters because the full credit is available for for the rest of that quarter and one quarter afterwards. (If the 200,000th EV is delivered to the customer by December 31, 2018, then the full federal tax credit will be in place through the end of March 2019; if it gets sold on January 1, 2019, the full federal tax credit will be in place through the end of June 2019. That’s a big difference!) See this article from Green Car Reports for more info.

Nissan, with the LEAF, gets the bronze medal and should be eligible for the full credit through 2020.

Other than those three, other carmakers are unlikely to hit 200,000 EVs sales until 2021 or 2022. We’re talking makes such as Toyota, VW, Ford, BMW, Volvo, etc.

Meanwhile, Tesla and GM are reportedly lobbying Congress to amend the tax credit law so that they can be eligible beyond 200,000 units. We’ll see how that goes.

State Rebates:

We understand that state rebates cannot go on forever, but there is ample evidence around the country and world that rebates work to increase EV adoption. California, which leads the nation on electric cars, is considering increasing its rebate from $2,500 to $4,500. California sees EV adoption as essential to meeting its aggressive greenhouse gas reduction targets. We admire California, in particular Governor Jerry Brown, for establishing tangible policies for meeting their goals.

In some places that offered rebates for a while and then suspended them, EV sales fell, especially for cars that would generally be considered affordable to the middle class. Higher-priced EVs, such as Tesla models, are generally purchased by consumers who are less price-sensitive.

There may be more sophisticated ways of encouraging consumer demand for electric cars, which we talk about below. But until they are in place, purchase and lease rebates are necessary or the states will not meet their EV or greenhouse gas emission reduction goals.

Rhode Island had a state rebate of up to $2,500 until June 30, 2017, but not since. State officials are having difficulty finding a funding source. Green Energy Consumers is trying to persuade Governor Raimondo and legislators to solve this problem. If you would like to help us in this cause, please email kai@greenenergyconsumers.org.

Massachusetts also has a state rebate of up to $2,500, but the program is currently running a deficit: rebates are being issued at a rate that is higher than incoming funding. We are hearing that the state will fund and maintain the rebate program through the end of December 2018, but are not in a position to guarantee that and do not have any further details. You can watch the state’s EV rebate website for more information, but please know that the state adds funds to the pot at certain (and unpredictable) intervals. As of this writing on October 24, 2018, the fund has $645,313 (6%) left, but just one day ago, the website listed funding as being negative, on the order of -$300,000. Between now and the end of the year, we expect that the pot may decrease to 0% a couple more times, depending on when and how often more funds are added. But let us be clear on one thing – if you are a Massachusetts resident looking at buying or leasing an EV – think hard about doing it in 2018.

Of course, if you are looking to buy or lease an EV, we can help! Through our Drive Green program, we offer a wealth of educational resources and a network of local dealerships who have committed to offering EVs to folks who come through our website at pre-negotiated, discounted prices. Check it out at: www.greenenergyconsumers.org/drivegreen

Other Incentives:

Though we are big proponents of state rebates in the short term, please don’t misunderstand us: they are not a long-term solution. For a few years, we believe that state rebates are important. But for the longer term, there are options that can better align the interests of individual consumers and the general public.

For example, we also advocate for policies that offer electricity rate discounts for people who charge their vehicle during off-peak periods, such as nighttime, weekends, and holidays. It’s a fact that it costs utilities and other electricity suppliers significantly less to provide service at these off-peak times. It’s a matter of supply and demand, and about utilizing spare capacity in the system. Since it’s cheaper to provide service at these off-peak times, the electricity supplier can afford to offer service at a lower price in exchange for shifting demand away from expensive times. In addition, because the utility will be selling more kilowatt-hours, it will be able to reduce the cost per kilowatt hour to everyone, whether they have an EV or not. And meanwhile, EV owners save on their electricity costs. It’s a win-win-win situation: for utilities, EV owners, and electricity users who don’t drive EVs.

As part of a recent rate case, National Grid in Rhode Island will be offering such a rebate on a limited basis. We are awaiting details and will encourage this policy in Massachusetts for customers of National Grid, Eversource, and Unitil. Some municipally-owned electric utilities offer similar discounts on off-peak charging.

Long Story Short

Long story short: yes, the federal tax credit is likely to start ratcheting down for Tesla, General Motors and Nissan within the next year, and yes, it looks like the MOR-EV state rebate in Massachusetts won’t exist in its current form past December. We are big proponents of extending both of these important consumer incentives to drive green. And of course we will keep getting discounts for consumers through our Drive Green program. However, back on the policy front, we have our eyes on more long-term, sustainable incentive mechanisms to accelerate EV adoption: particularly off-peak charging rebates that could make EVs more attractive for more consumers, at a smaller cost per consumer than purchase rebates, and provide other benefits to our electric grid and even folks who don’t drive electric cars.

We believe electric cars are great. They

We believe electric cars are great. They

Comments