Electric Cars That Qualify for Federal Tax Credit to Change on April 18

Back in January, we reported that the federal government was delaying the implementation of the complicated new...

The transition to electric vehicles (EVs) is a central pillar of the Biden administration’s commitment to reducing carbon emissions and combating climate change; and the federal Clean Vehicle Tax Credit is a key part of the administration’s approach. In 2024, that incentive changes in two ways: it becomes available at the point-of-sale and new battery provisions kick in that will likely reduce the number of eligible vehicle models.

To help speed up this transition, the U.S. Treasury Department has recently laid out some updates to the new clean vehicle tax credit and the previously owned clean vehicle tax credit. Starting January 1, 2024, the clean vehicle tax credits can be accessed as point-of-sale rebates at participating dealerships. This is great for two reasons:

This is a huge win for anyone who wants an EV!

Currently, EV buyers must purchase the car and then apply for a federal tax credit when filing taxes. Thus, the savings from the tax credit can take many months to come to fruition. Consumers are also limited by their own tax liability.

Note: Leased vehicles are eligible for a commercial EV tax credit, which many automakers pass on to consumers. With so many vehicles losing their federal incentive eligibility (more on that below), leasing may be the most attractive option for many consumers.

Starting in 2024, consumers can choose to receive savings at the point-of-sale at participating dealerships, simplifying the process and making EVs more affordable from the outset. If the dealership is not participating in the federal program, the process will not be at point-of-sale but instead, the tax credit will be applied when filing taxes. The list of participating dealerships has yet to be made available.

The Treasury Department’s plan for implementation structures the program in a way that does not place undue burden on car dealers, ensuring the initiative is successful. Dealers interested in offering the credit at the point of sale must register with the IRS, and buyers must confirm that they meet the tax credit’s income limit. The current modified adjusted gross income (AGI) limits:

Buyers can then choose to receive cash or apply the credit toward the cost of the EV. The process, as planned, is intended to streamline the rebate application, and make it easier for consumers to purchase an electric vehicle. If a buyer’s income exceeds the limit, they will need to repay the credit to the IRS when they file their taxes.

As an important note, buyers who elect to receive the rebate at point of sale can access the rebate regardless of their tax liability for both new and used battery electric vehicles and plug-in hybrids. In other words, if the total tax you owe to the federal government is only $4,000 and you buy a vehicle that qualifies for $7,500, you will get the full $7,500 at point of sale but only $4,000 if you take the credit at tax time.

As you might be able to tell, this can get complicated and there are a lot of moving pieces, for more information, please see our incentive page here.

Additional changes for next year include (a) an increase in battery and mineral component requirements and (b) a new provision on foreign entity of concern requirements.

Increase in Battery & Mineral Components

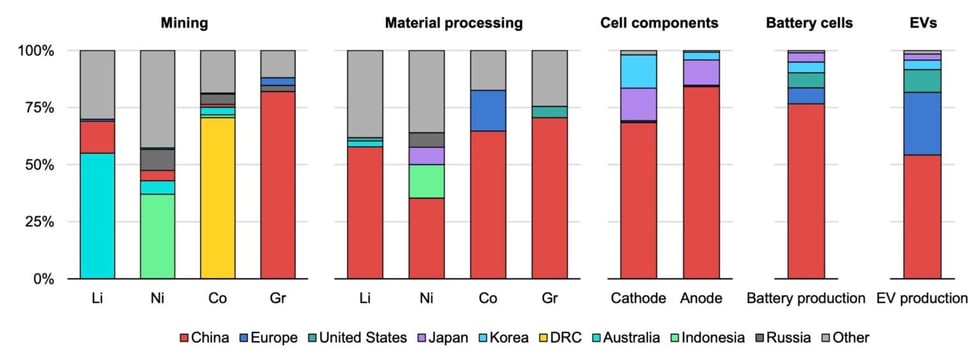

In addition, starting in 2024, a qualifying electric vehicle cannot include battery components manufactured by a “foreign entity of concern.” The Treasury and IRS will issue further guidance on this provision, but so far, the countries they’ve designated as “entities of concern” include North Korea, China, and Iran. This provision will likely cause drastic changes in the list of eligible vehicles because China is a major manufacturer of batteries and battery components, as seen in the graph below from the Global Supply Chains of EV Battery report from IEA.

If you are interested in learning more about global supply chains, check out this blog we wrote. We’ll know more details in the coming weeks, but this article from Clean Technica offers some educated guesses as to which vehicles no longer be eligible in 2024: Chevrolet Bolt EV, Equinox EV, and Silverado EV; Ford F-150 Lightning; Tesla Model 3 Performance, Model Y Performance, and Model X.; and Cadillac LYRIQ. We will certainly write another blog when we know more!

As 2024 approaches, the landscape of electric vehicle adoption is poised for significant transformation, and the changes to point-of-sale rebates should be lauded. This will mark a pivotal moment in making EVs more accessible to all, removing the burden from lengthy tax credit processes on the consumer and providing funds immediately to help reduce the cost of EV models. This initiative aligns with the wider mission of curbing carbon emissions and combating climate change. While the new battery requirements may make certain EVs no longer eligible for a rebate, we hope the ease of receiving the tax rebate will increase EV adoption across the country. Be sure to stay tuned for updates and details on participating dealerships and eligible vehicles, as we embark on this exciting journey toward a greener and more equitable future.

Back in January, we reported that the federal government was delaying the implementation of the complicated new...

The Internal Revenue Service (IRS) offers a federal tax credit of $2,500 to $7,500 per new electric vehicle (EV)...

Comments