Federal Tax Credit in Jeopardy

As you may have heard, the existing federal tax credit of up to $7,500 for electric vehicles (EVs) would be...

The Internal Revenue Service (IRS) offers a federal tax credit of $2,500 to $7,500 per new electric vehicle (EV) purchased in the United States. Right now, both the Chevrolet Volt and Chevrolet Bolt qualify for the full $7,500 federal tax credit. However, as of April 1st, the credit will be cut to $3,750 as the tax credit phases out for General Motors vehicles. If you want a Bolt or a Volt, we highly recommend you get it before April 1st to take full advantage of this incentive.

The size of the tax credit depends on the size of the vehicle’s battery. The Chevrolet Bolt, for example, has a 60 kilowatt-hour (kWh) battery and as such qualifies for the full $7,500 tax credit. In contrast, the Toyota Prius Prime has a significantly smaller battery size of only 8.8 kWh and thus qualifies for a partial federal tax credit of $4,502. For a complete list of cars eligible for the federal tax credit, click here. It is important to note that a tax credit reduces the total amount of income tax you owe. To explain further, if you purchased an EV eligible for the full $7,500 tax credit and owed the IRS $10,000, applying the tax credit would change that $10,000 owed to $2,500. If however, your EV is eligible for the full $7,500 tax credit, and you only owe the IRS $2,500, you will not receive more than what you owe to the IRS. In other words, the IRS will not write you a check for the difference and you cannot carry over any of the credit to the following year.

The federal tax credit is designed to phase out once a manufacturer has hit a cap of 200,000 qualified EVs sold. The credit starts to phase out three months after the close of the quarter in which the manufacturer hits the 200,000th car sold. The initial tax credit amount halves after this period of time for six months, then halves again for an additional six months, and will then expires completely.

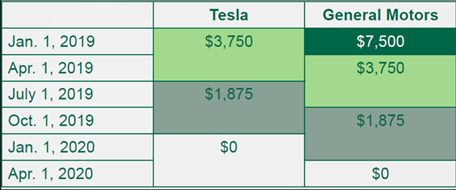

Tesla reached this milestone first in July 2018. Tesla customers were initially able to receive the full $7,500 tax credit, but as of January 2019, Tesla’s tax credit amount has been reduced to $3,750. In July 2019, the credit will decrease to $1,875 tax credit and by January 2020, it will be completely phased out.

General Motors (GM) hit the 200,000 unit cap next, in the fourth quarter of 2018.As a result, the Chevrolet Bolt and Volt will only have until March 31, 2019 to be eligible for the full $7,500 tax credit. The credit will halve on April 1 and then halve again on October 1 until it is completely phased out on April 1, 2020.

As a major American car manufacturer, GM was one of the first to focus on pushing EVs, so it’s no surprise that they reached the cap earlier than other manufacturers. However, this puts GM at a disadvantage with other manufacturers who have only more recently started to push the sale of EVs, like Mitsubishi and Hyundai, for example.

The Bolt and Volt are both affordable examples of a battery electric vehicles (BEV) and plug-hybrid electric vehicles (PHEV), respectively. The Bolt has been leading the way in electric range with up to 238 miles per charge. For those with “range anxiety” this is a huge win! The Volt, on the other hand, gets 53 miles per charge and has a gas backup. Although 2019 marks the end of Volt production, it has been a huge hit among EV owners. The Volt is one of the only PHEVs with an electric range of 50+ miles. However, GM has decided to shift focus on producing more all-electric cars in the future and has just ended production of the Volt.

So what does this mean for the consumer? If you’re interested in the Chevrolet Bolt or Volt, it would behoove you to make your purchase before April 1; take advantage of the tax credit while you can and sign-up for a test drive with our Drive Green program.

One more thing! If you’re a Massachusetts resident, you may have heard that there have been changes to the Massachusetts Offers Rebates for Electric Vehicles program (MOR-EV). Residents of Massachusetts used to be able to apply for the MOR-EV rebate on any BEV or PHEV. As of January 1, 2019, MOR-EV allows for a $1,500 rebate for BEVs under the $50,000 mark, but this does not include PHEVs.

As you may have heard, the existing federal tax credit of up to $7,500 for electric vehicles (EVs) would be...

If you are in the market for a new or used electric car, plan to get it before September 30, 2025. The “Big...

Comments