Recently, electric vehicles (EVs) have been in the news because various states around the country – including our very own Rhode Island – are introducing extra registration fees for EVs. Though in some cases these fees are clearly punitive and motivated by politics, these registration fees are being justified as a way to balance out the fact that EV drivers don’t pay the gas tax. Here at Green Energy Consumers, we oppose a special EV registration fee – it's a disincentive to electrify at a time when we need to replace combustion engines as quickly as possible with EVs. However, the question of how to fund our roads and bridges is a fair one. It’s just way bigger than EVs versus gas cars.

We Need EVs

Transportation is the largest source of greenhouse gas emissions in both Rhode Island (and Massachusetts), and every serious climate study and both states’ climate plans stress that electrifying the vehicles on our roads is key to reducing emissions in this sector. Also, increasing EV adoption benefits those of us who don’t yet drive electric, too. EVs benefit our state economics by keeping more dollars in the region (because of reduced gasoline imports) and by putting downward pressure on electricity rates. Not to mention the immediate impact of reducing the pollution that harms human health by replacing internal combustion engines on the roads. According to the Environmental Protection Agency, the “social cost of carbon” for gasoline is about $2 per gallon (you can read more on that here). Most of that figure is traced to health costs.

Placing a Fee on EVs in Rhode Island Is a Bad Idea

A few weeks ago, the Rhode Island Fiscal Year 2026 budget was released, revealing a much-discussed state budget deficit of approximately $250 million. On page 46 in the executive summary, the governor’s budget proposes a new fee on electric vehicles (EVs): an additional $300 to the two-year registration fee for battery electric vehicles and $150 for plug-in hybrid vehicles. The budget action specifically calls out RhodeRestore, a state program that provides matching funds for local road paving projects, as a program that could be enhanced with the revenue. The fee is projected to raise $1.7 million in FY 2026, and $13.9 million in FY 2030. We strongly oppose this proposal and told the Providence Journal as much.

Increasing adoption of electric vehicles is a critical step in Rhode Island reaching its Act on Climate required emissions reductions, and imposing a new fee on EV owners will only disincentivize further adoption of these vehicles. When you take a closer look at the numbers, it all doesn’t add up. The average Rhode Islander drives around 10,000 miles per year. We did the math to see what drivers of different types of vehicles would pay with some simple efficiency assumptions. The math shows that $150 per year is more than a driver of the super-inefficient Chevy Silverado would pay in a year! Furthermore, because the average sales price of an EV is still higher than the average new gas-powered car (although that is changing as battery prices come down), EV drivers are already paying more to state and local government with higher sales and excise taxes.

Examples of gas tax expenditures by car model:

| Vehicle |

Annual Miles Driven* |

Miles Per Gallon* |

State Gas Tax |

Annual Gas Tax Cost |

| Toyota Prius |

10,000 |

50 |

$0.37 |

$74 |

| Chevrolet Silverado |

10,000 |

25 |

$0.37 |

$148 |

| Honda CRV |

10,000 |

30 |

$0.37 |

$123 |

| Toyota RAV-4 |

10,000 |

28 |

$0.37 |

$132 |

Right now is not the time to assess a disproportionately large fee on EVs to raise a negligible amount of revenue for transportation funding. What we need in this moment is to continue full steam ahead on EV adoption while seriously studying the options for transportation funding broadly, not just replacing the gas tax specifically, and planning for the future.

We Need to Think Broader Than the Gas Tax

There are two per-gallon taxes you pay at the pump: the federal tax and the state tax. Since 1993, the federal tax has remained at 18.4 cents per gallon and the state tax varies, but in Rhode Island the current tax is 37 cents per gallon. Since 2015 the Rhode Island gas tax has been adjusted every two years to keep up with inflation.

It’s often thought that the state gas tax funds roadway maintenance but in Rhode Island the gas tax only funds about 9.7% of the Department of Transportation's budget with the remainder of gas tax revenue going to the Rhode Island Public Transit Authority and the Turnpike and Bridge Authority.

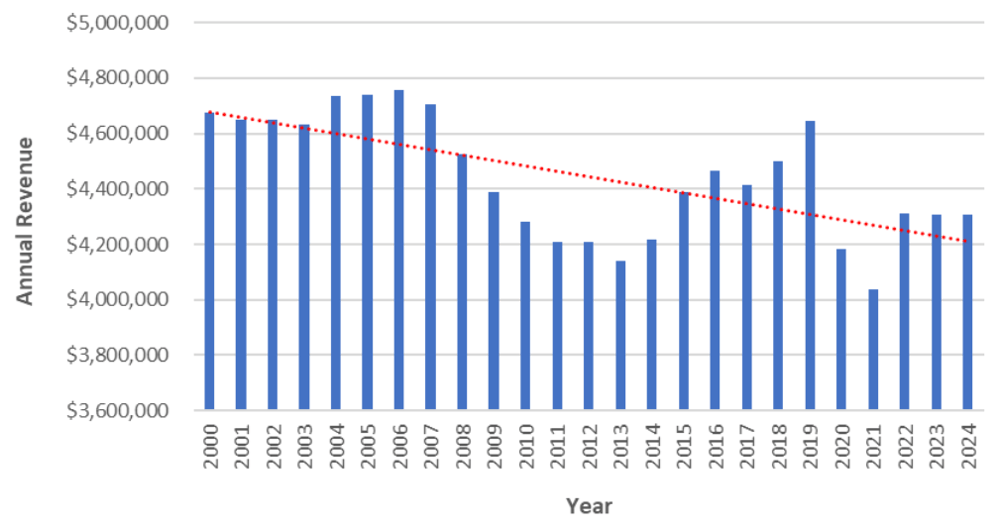

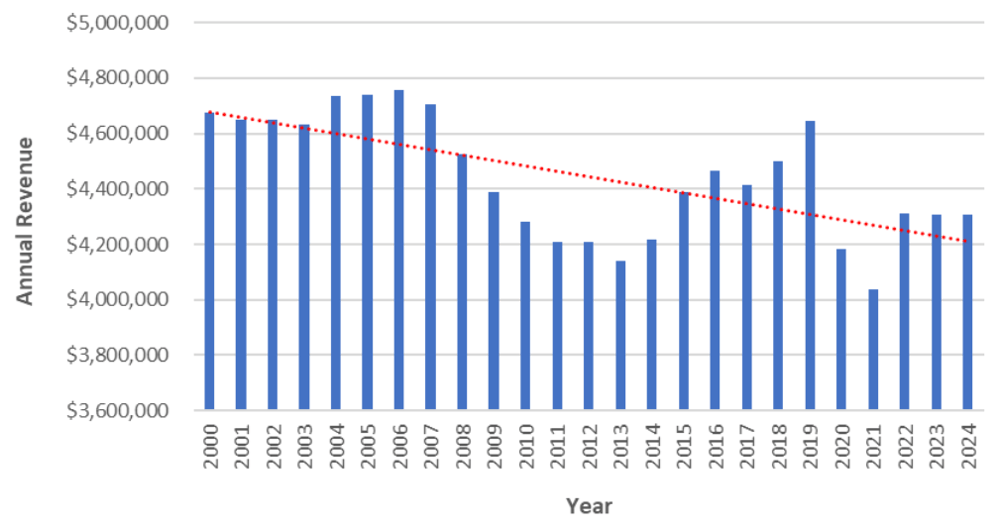

Gas tax revenue has been trending downward over time, thanks to the increased efficiency of gas-powered cars. At the same time, we’re seeing people driving larger and larger vehicles, and more and more miles per year, which is slowing the decline we might see otherwise. Regardless, revenue has not kept up with the costs of maintaining our transportation system for a long time, especially as inflation has increased construction costs. But you’ll note that the decline has been going on for decades, and the last ten years, where EVs have been most prevalent, have not seen a dramatic decline in revenue (outside of the one caused by COVID-19).

Rhode Island Gas Tax Revenue

Graph created from data requested from the Rhode Island Department of Revenue

Alternative Funding Streams

We need a suite of funding sources to not only maintain our existing transportation infrastructure but also to expand access to clean and climate-resilient modes of transportation. Currently, we’re using a mix of resources to pay for transportation: fuel taxes, registration fees, general sales taxes and vehicle sales taxes, tolls, transit fares, local assessments, fees on transportation network companies (TNCs) like Uber and Lyft, federal funding, income and property taxes, etc. But that’s not been adequate to even maintain a state of good repair across the system. So what tools are at our disposal to both maintain, modernize, and decarbonize?

Here are a few ideas:

- Weight/Size-Based Excise Taxes/Registration Fees: Larger vehicles cause more damage to our roads and bridges, not to mention posing a bigger threat to pedestrians and bicyclists. Colorado, Maryland, New Jersey, and New York all have weight-based fees per the Massachusetts Transportation Funding Task Force report (p. 85). It’s also important to note that vehicle weight tends to correlate with vehicle expense, so assessing a fee based on weight would fall more on more expensive vehicles. Increasing the fee on these heavy, expensive cars is more progressive and would raise more revenue immediately than a fee imposed solely on EVs.

- Mileage-Based User Fees: We should all pay into the system proportionate to the damage we cause. That’s how the gas tax is supposed to work: the more gas you buy, presumably the more you are driving and polluting, and the more you pay in. As we move towards more efficient and/or electric vehicles, the number of gallons consumed is no longer a good proxy for damage to roads and bridges. Instead, what we really need to measure is vehicle miles traveled (VMT), with some consideration of vehicle weight and fuel used. Jurisdictions around the country and world are looking into mileage-based user fees, and a Massachusetts Funding our Future report recommends studying this idea more. We agree.

- Transportation Network Company (TNC) and delivery fees: More and more of the wear and tear on our roads is being caused by TNCs like Uber and Lyft or delivery vehicles every year – everything from Amazon trucks to GrubHub deliveries. According to the report of the Massachusetts Transportation Funding Task Force (p. 88), for Uber/Lyft rides, Massachusetts charges $0.20 per trip (with revenue going to transportation specifically), while Rhode Island just levies the 7% sales tax (with revenue going into the General Fund). Other states do more: Colorado levies $0.30/trip; Washington, D.C., $0.25 plus 6% of total fare; Georgia, $0.50/trip; and in all three cases, all the funding generated goes to transportation broadly or transit specifically.

- Progressive Taxation Policy: In Massachusetts, Governor Healey recently announced a ten-year plan to invest $8 billion in transportation, funded largely by the Fair Share Amendment, which levies an addition 4% tax on personal income over $1 million (with revenue dedicate to transportation and education). The Funding Our Future report recommends corporate tax tiers that levy higher taxes on larger companies and eliminating exemptions that disproportionately benefit the wealthy (such as, for example, a sales tax exemption for the sale of aircraft).

With all of these ideas, the details of implementation are key, and care must be taken to make sure they do not disproportionately impact low-income residents.

Rhode Islanders: Take Action

If you’re a Rhode Islander, take action on Tuesday, February 25, to oppose this electric vehicle fee.

Option 1: Write an email to HouseFinance@rilegislature.gov by February 25th with your testimony in pdf form.

We recommend this template: “Dear Chair Abney and members of the Committee, my name is [Name] and I live in [City/Town] RI. I am submitting testimony in opposition to the proposed electric vehicle registration fee in Governor McKees proposed FY 2026 budget (H5076 Article 5 Section 3). To meet our Act on Climate emissions reductions, we must replace more gas cars with electric vehicles, and this fee would disincentivize EV adoption."

If you’re an EV owner, add something about your experience and how an additional fee would have impacted you.

Option 2: Attend the hearing in person.

Details: The hearing will be held on February 25th in room 35 at the Rhode Island State House. The hearing will begin at the Rise of the House, around 4:30pm. View the agenda for the hearing here.

If you do take action, or if you have any questions, please email Tina Munter, tina@greenenergyconsumers.org.

Comments